E-Invoice

This module enables businesses to generate e-Invoices directly from our ERP system with seamless integration to the official GST portal. From sales, orders, and invoices, users can create legally compliant e-invoices, print them, and cancel if needed — all within the platform.

Automate Your e-Invoice Generation

For every sale, order, or invoice created in the system, a dedicated 'Create e-Invoice' button is available. Once clicked, the invoice details are transmitted to the government’s e-Invoice portal for validation and IRN (Invoice Reference Number) generation.

Want to understand the E-Invoice Module in detail? Download the full documentation below:

Key Features of E-Invoice Management

1. One-Click e-Invoice Creation

Instantly generate e-Invoices from sales, orders, or invoices using the 'Create e-Invoice' button, ensuring legal compliance.

2. Seamless GST Portal Integration

Direct integration with the government’s GST portal enables fast IRN and QR code generation.

3. Print e-Invoices

Easily print e-Invoice documents that include the government-issued QR code and IRN.

4. Cancel e-Invoices

Use the 'Cancel' button to revoke any generated e-Invoice when necessary.

5. Time Limit for e-Invoice Generation

E-Invoices must be generated within 30 days from the invoice date, as per current regulations. Businesses must ensure timely generation to remain compliant.

6. Applicability of E-Invoicing

E-invoicing is mandatory for businesses with a total turnover exceeding ₹5 crore in any financial year from 2017-18 onwards. The turnover includes all GSTINs under a single PAN across India.

How It Works

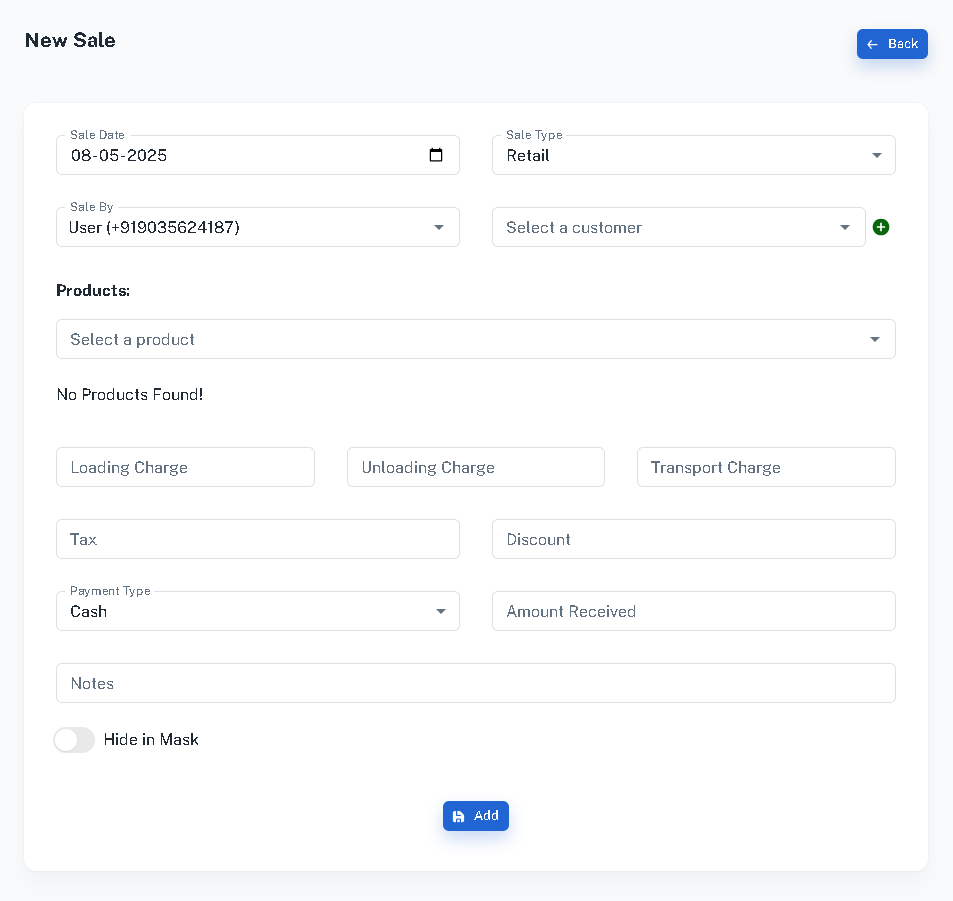

1. Create Sale/Order/Invoice

Complete a sale, order, or invoice entry in the system.

2. Click ‘Create e-Invoice’

Use the button available beside the record to send data to the GST portal for IRN generation.

3. Print or Cancel e-Invoice

Download and print the invoice, or cancel it using the available cancel button, as needed.

E-Invoicing Essentials

Overview

Quickly generate GST-verified e-Invoices with a single click for all your Sales, Orders, and Invoices. The integrated options allow you to print or cancel the document, all while staying fully synced with the government’s e-invoicing platform.

Key Features

-

E-Invoice Generation

- Instantly issue e-Invoices from Sales, Orders, or Invoices using the designated button.

- Real-time generation of IRN through government portal integration.

-

Print and Cancel Options

- Easily print e-Invoices with embedded QR codes.

- Revoke any issued e-Invoice when needed using the cancel option.

-

E-Invoice Time Limit & Compliance

- Must be issued within 30 days from the invoice date per government mandate.

- The earlier proposed 7-day limit has been deferred until further notice.

-

Eligibility for E-Invoicing

- Applies to businesses exceeding ₹5 crores turnover in any year since 2017–18.

- Turnover includes all registered GSTINs under one PAN.

Overall Features of the E-Invoice Module

-

One-Click e-Invoice Creation

- Generate e-invoices instantly from Sales, Order, and Invoice modules with a single click.

-

GST Compliance

- E-invoices comply with government GST rules and are officially registered on the GST portal.

-

Real-Time Synchronization

- The module sends invoice data to the GST portal and receives IRNs instantly.

-

Error Handling and Notifications

- Displays error messages from the GST portal for easy troubleshooting and quick resolution.

-

Secure Transactions

- Encrypted connection ensures safe and secure transfer of invoice data.

Ensure Legal Compliance with E-Invoicing

Our integrated e-Invoice module simplifies compliance with GST rules, helping your business avoid penalties while maintaining accurate, government-verified records.